Strategy for Making Money — Entering After the Pump

Author: @MacnBTC

Let me first tell you a story about how I missed out on a ton of profits because of a stupid psychological mindset I picked up early in my trading career.

For the longest time, I was that guy who thought,

“It already pumped — too risky to jump in now.”

Then I’d go hunting for lagging altcoins in the same sector — the ones that hadn’t moved yet — and buy them instead.

That’s the dumbest thing you can do.

Let me explain.

Just because something has started pumping doesn’t mean it’s too late to get in.

You just need to be smart about it.

Most of the time, you’re not going to catch the first pump — and that’s fine. It doesn’t matter.

Here’s the step-by-step playbook for Scenario 1: A coin starts flying after accumulation.

-

Find the winners (the coins that are pumping).

-

Watch them.

-

Learn how to enter on consolidations and pullbacks.

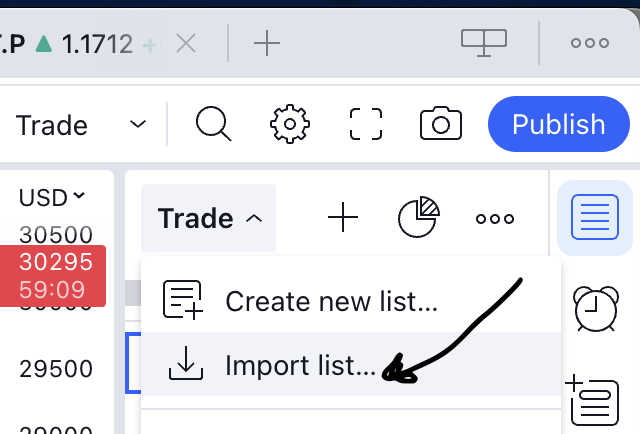

Step 1: How to quickly find the right setups

You want to build watchlists on TradingView and monitor when something starts moving.

To get the Binance watchlists, go to this link from your computer:

https://sandwichfinance.blob.core.windows.net/files/binancefuturesf_usdt_perpetual_futures.txt

(This is a direct file link from https://sandwich.finance).

Import the list into TradingView and you’re ready to go.

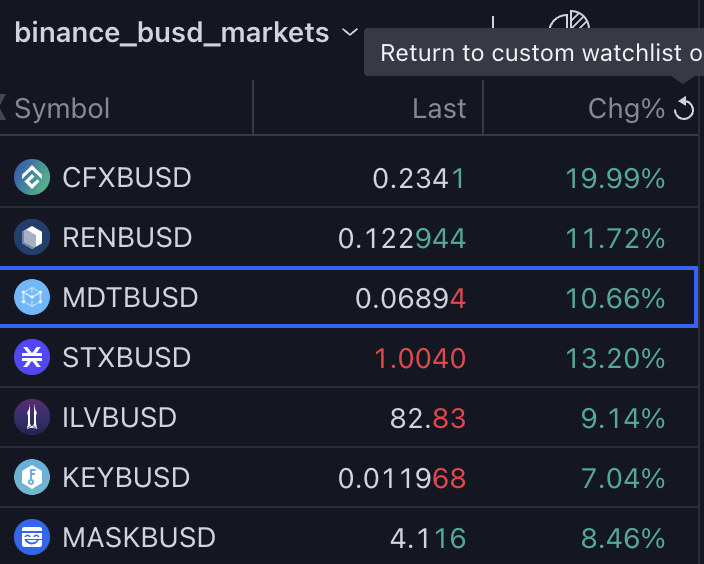

Sort by % change once a day

-

Keep track of the winners:

We want to monitor assets that are at the top of the daily percentage change list. Import them into your main watchlist.

Now let’s look at an example of how this would look in practice.

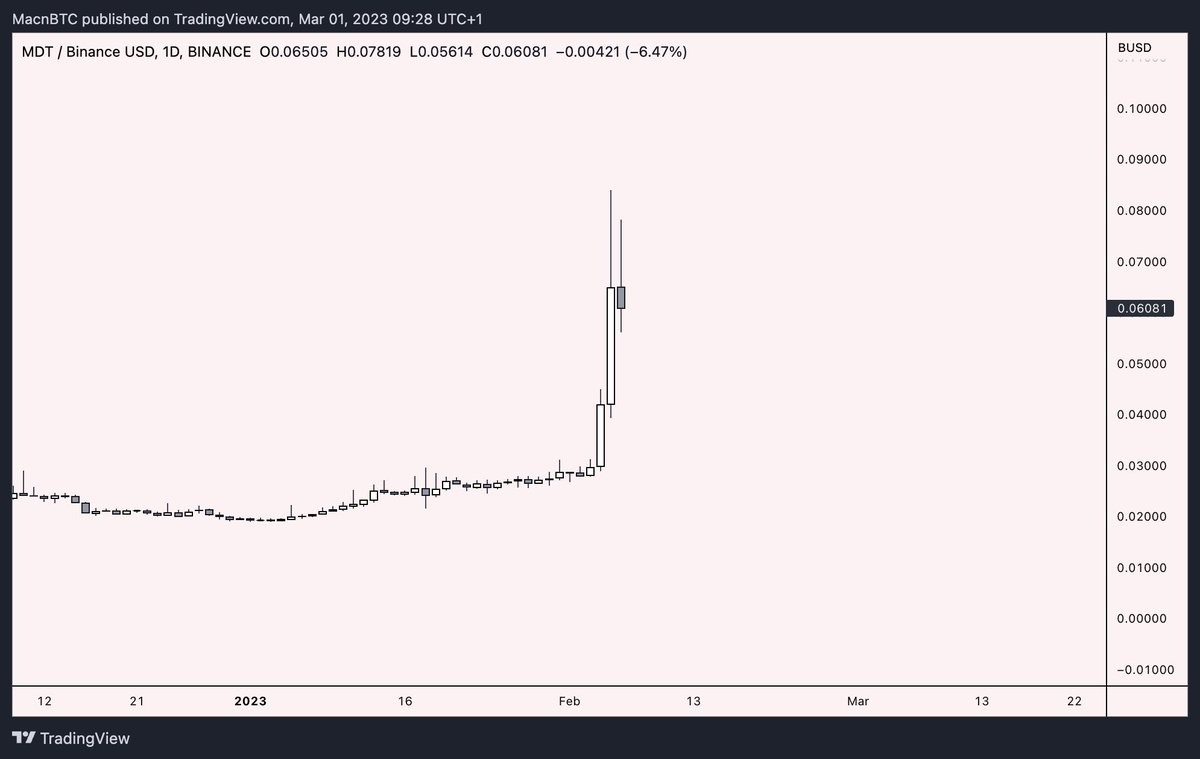

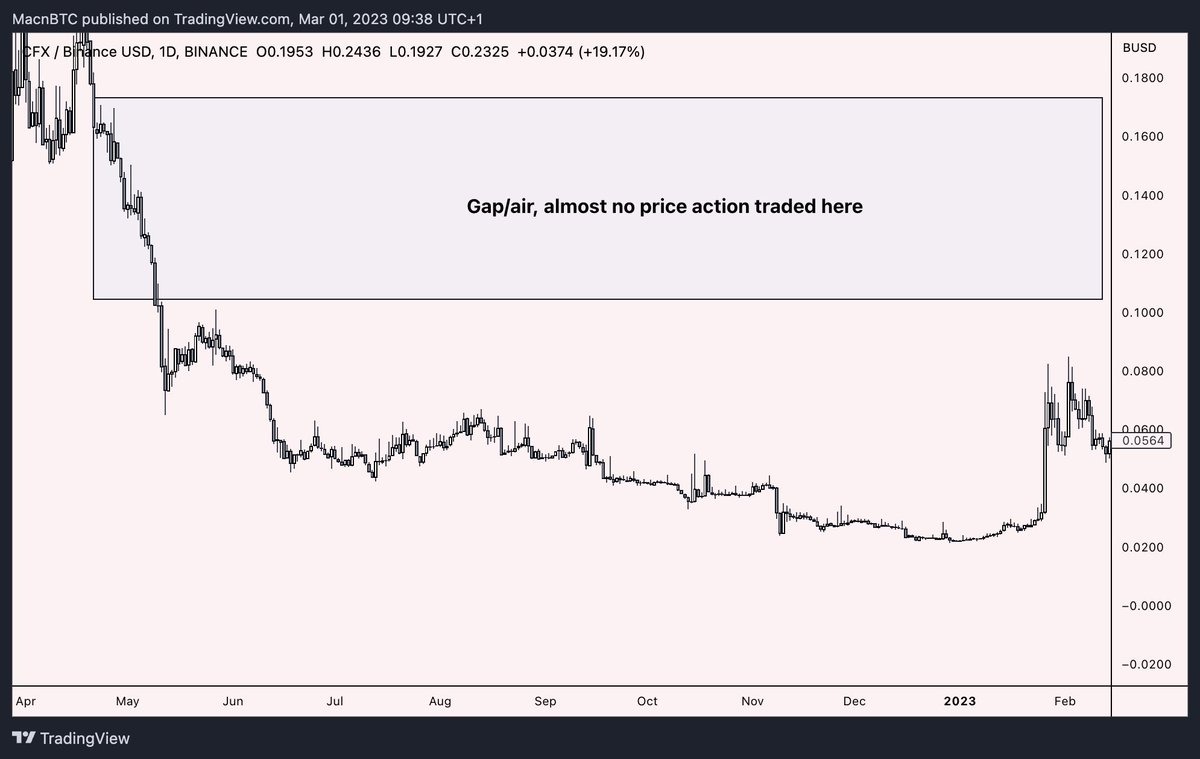

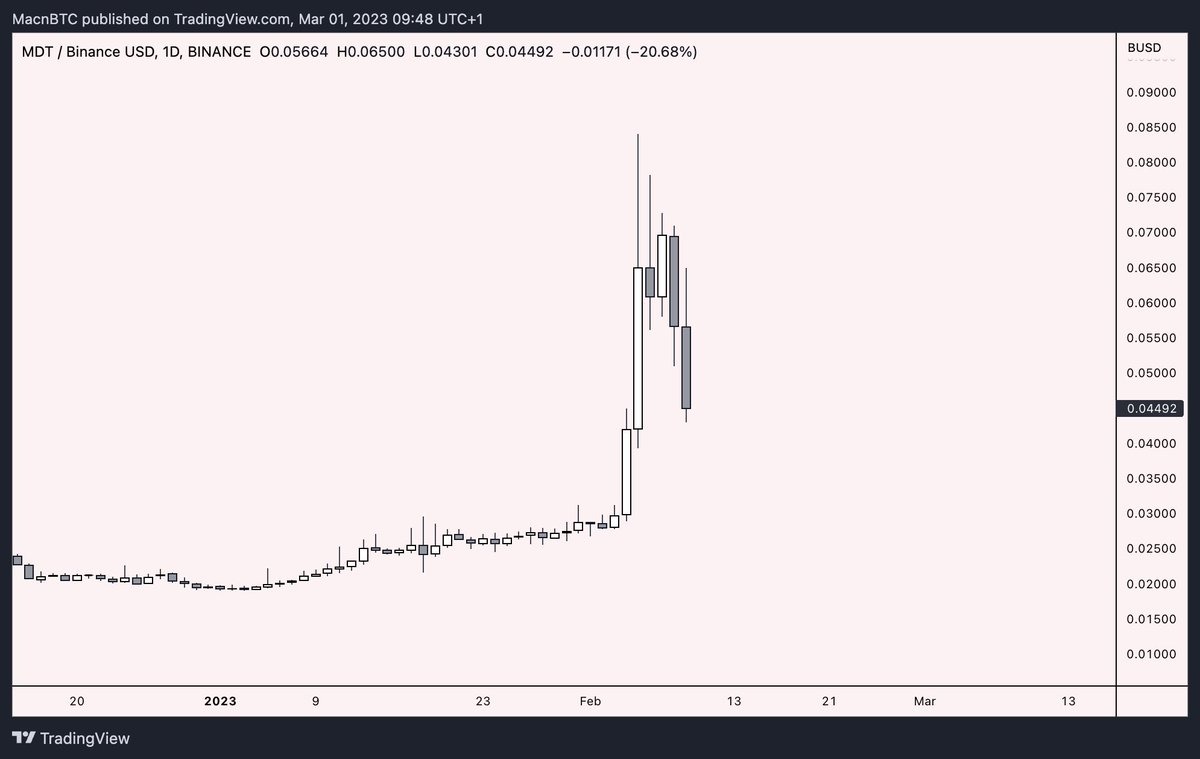

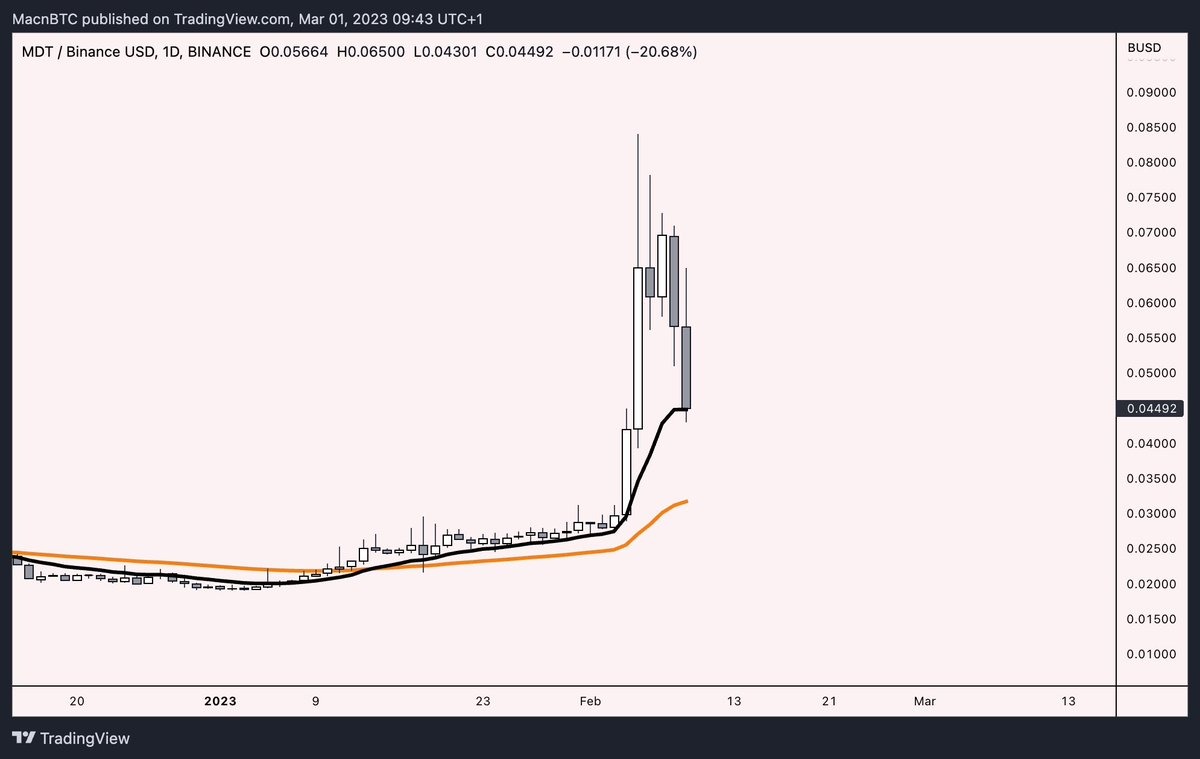

$MDT is a recent example. At the beginning of February, $MDT had the highest daily gains for two days in a row.

We missed the pump. But we know a pullback will happen, giving us a good chance to catch a solid bounce.

Now you probably have a lot of questions like “how do I know if it’s going to keep pumping” — simply put, you zoom out, check resistance levels, and look at the moving averages (MAs).

If the trend on the higher timeframe (1D) looks reset, there was a decent pullback, or there’s a big gap to the next resistance, then the asset is a good candidate for continuation.

We only want to buy/enter during:

a) Consolidations

b) Pullbacks

The tools we’ll use to mark levels and trends will help us with this.

-

Moving averages like the Daily SMMA 7, SSMA 25, 4H MA 200, and 4H EMA 200

-

VWAP (Volume-Weighted Average Price)

In this guide, I’ll focus only on how we can enter using moving averages.

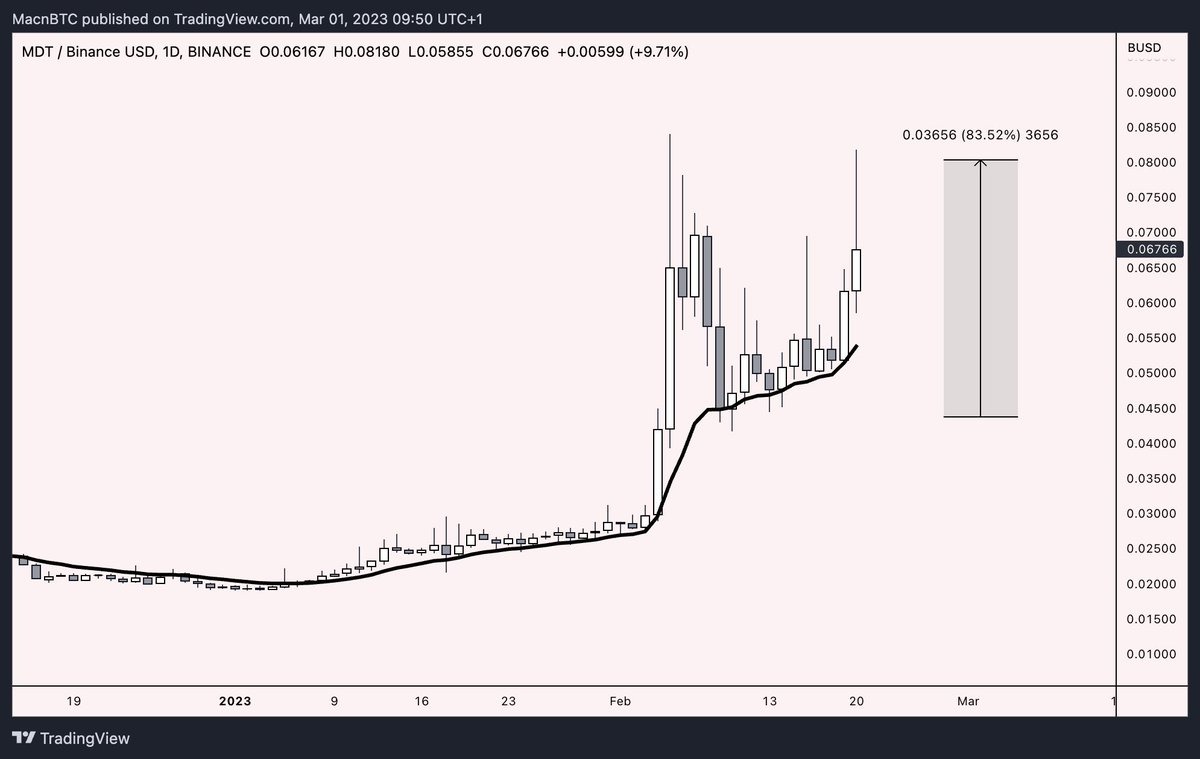

Now, let’s get back to our $MDT example.

So, how do we enter on pullbacks?

There are a lot of strategies, but let me share the ones that have worked well for me.

After a pump, you want to wait for a pullback. Often, the stronger and faster the pump, the more aggressive the pullback will be.

Timeframe — 1D

Simple strategy: buying the first pullback to the Daily SSMA 7

Go to the indicators tab and search for SMMA (Smoothed Moving Average).

Smoothed Moving Average

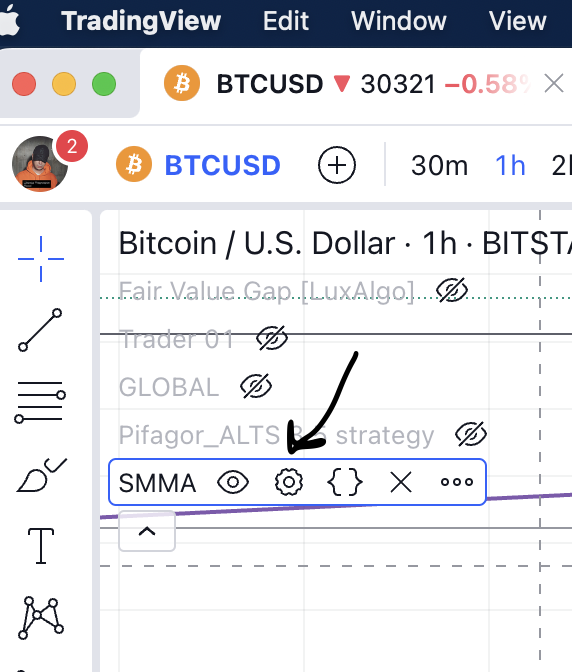

Click and apply it to the chart. On the left side, you’ll see SMMA. Click on the settings.

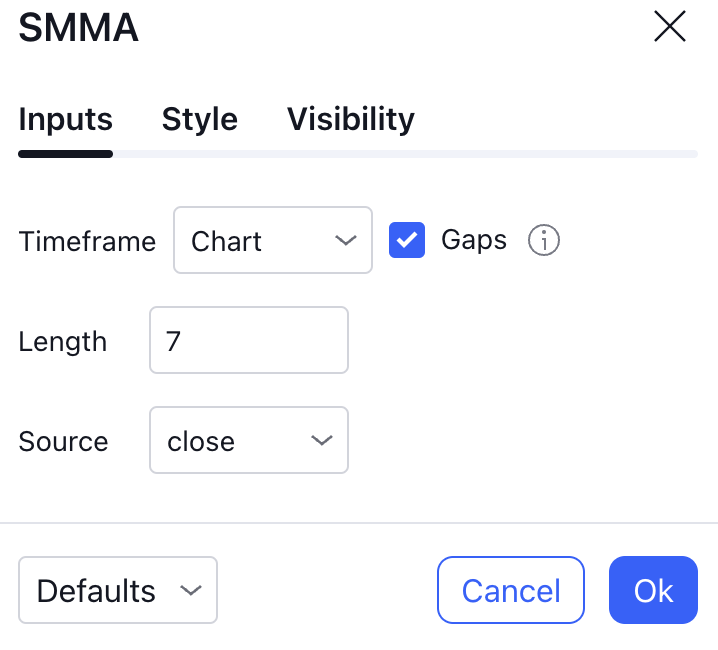

In the settings, set the number to 7.

You can find the other indicators yourself and check their settings.

This is a high-return strategy.

If the daily candle closes way below the SSMA 7, then I don’t enter.

This strategy is so simple and brilliant because we’re just trading with the daily trend, assuming that if the asset is bullish, it will bounce and continue pumping.

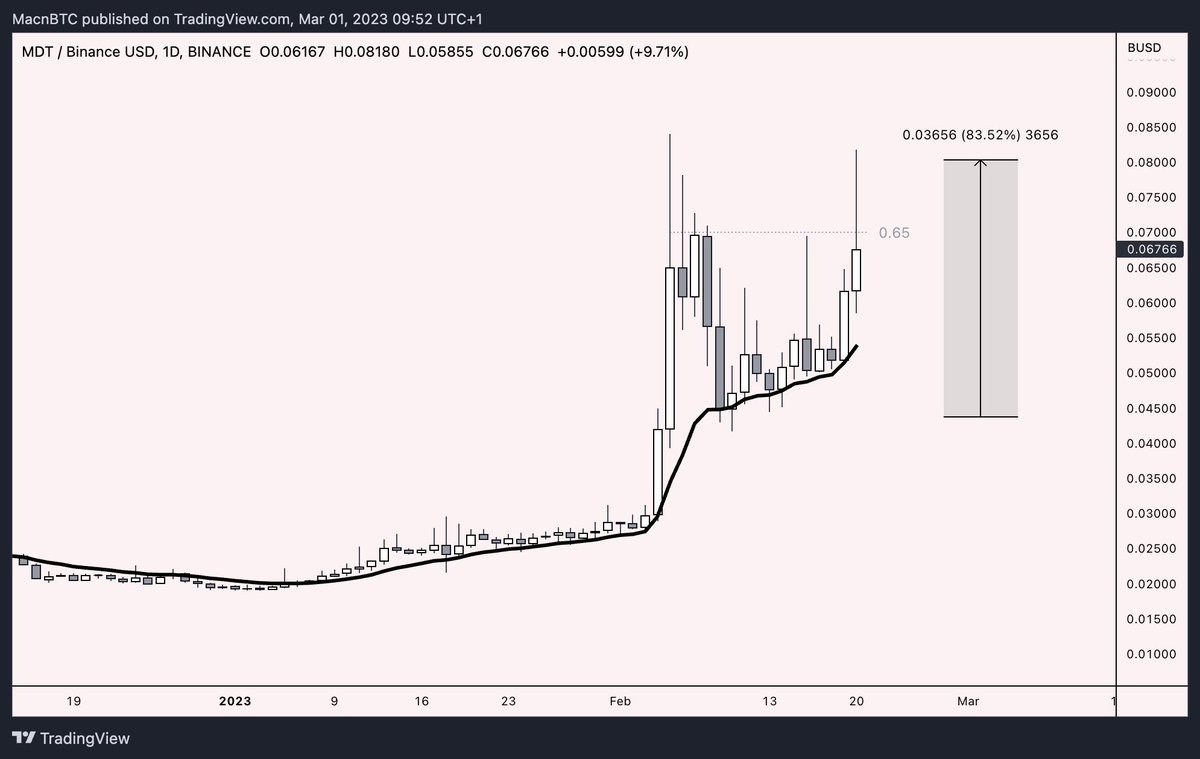

If you want to know where to set your targets, you can simply draw a Fibonacci line (you can find tutorials on how to use Fibonacci on YouTube) from the top down to the daily SSMA7 and aim for the 0.65 Fibonacci level like this.

Usually, the price at least retests the 0.65 Fibonacci level.

Comments are closed.