SCROLL raised $80 million but earns only $669 per day.

When Scroll raised $80 million from Polychain, Bain Capital, and Sequoia, the crypto space held its breath. A new ZK-rollup was born — supposedly the next evolution of Ethereum scaling, the zkEVM we’d all been waiting for. Expectations were high. The launch happened. The marketing rolled. Some DeFi apps and bridges appeared… and then, silence.

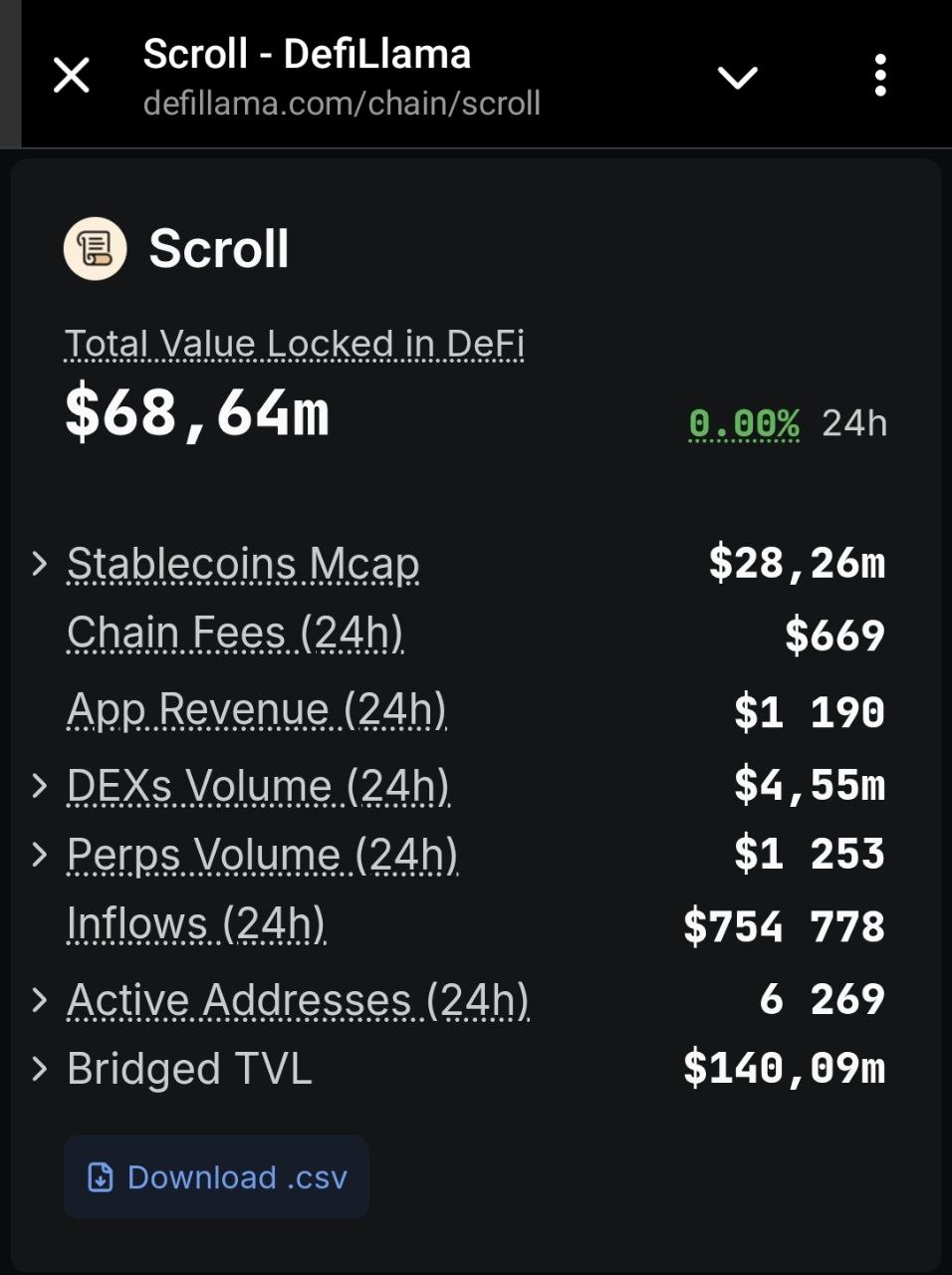

We checked DeFiLlama — here’s what the numbers say:

Key Metrics from Scroll (via DeFiLlama):

TVL — $68.64M

A surprisingly low amount of locked liquidity for a Layer 2 network that raised $80M. Indicates weak interest from protocols and capital providers.

Stablecoins Mcap — $28.26M

The total stablecoin supply is under 50% of TVL, which is a red flag for a network’s transactional utility. It suggests limited day-to-day usage and capital movement.

Chain Fees (24h) — $669

Incredibly low fee generation, showing that on-chain activity is minimal. The network is not being used at scale.

App Revenue (24h) — $1,190

Less than $1.2K per day from the entire Scroll app ecosystem — alarmingly weak revenue for a chain with a billion-dollar valuation.

DEXs Volume (24h) — $4.55M

Daily decentralized exchange volume is underwhelming. Smaller chains push more volume; this suggests lack of liquidity and trading activity.

Perps Volume (24h) — $1.25M

Perpetuals and derivatives trading is nearly nonexistent — a key growth vertical that Scroll hasn’t activated at all.

Inflows (24h) — $754K

New capital entering the chain is minimal. Scroll isn’t attracting liquidity from the broader market.

Active Addresses (24h) — 6,269

Under 7,000 active addresses per day — extremely low engagement for a mainnet network. Community growth is flatlined.

Bridged TVL — $140.09M

More assets have been bridged into the network than are actively being used. This implies that liquidity enters — and then sits idle.

What does this tell us?

Scroll was positioned as a technically advanced zkEVM-based Layer 2 with elite backers and strong narratives. But the data paints a very different picture:

Extremely low user activity

Poor economic performance

Lack of protocol engagement

No sign of product-market fit

These aren’t metrics from a thriving blockchain — they resemble a testnet left running in the background.

P.S. As usual, I take every project lightly and don’t put much stock in their promises. We’ll grab what we can from this and say arrivederci.

I’ve set three sell targets. Whichever one hits, that’s where I’ll sell.

For now, this pink wrapper looks like pretty much every other altcoin.

Comments are closed.