How Wall Street Is Secretly Entering Crypto Through ConsenSys

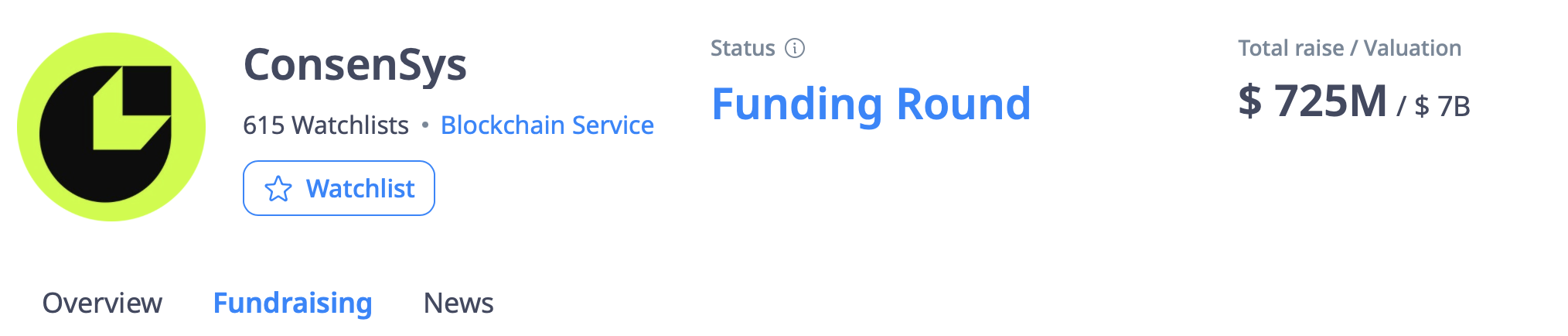

ConsenSys is a company founded in 2014 by Joseph Lubin, one of the co-founders of Ethereum.

The company’s main focus is on Ethereum and related technologies. ConsenSys provides a range of products and services, including infrastructure solutions, developer tools, educational programs, and consulting. They have advised major companies like Microsoft and Shell, and they actively contribute to the creation and growth of decentralized applications (DApps) and smart contracts.

ConsenSys also plays a major role in the Ethereum ecosystem and the broader blockchain community by supporting various initiatives, startups, and projects aimed at advancing blockchain technology and integrating it into different areas of business.

Key products by ConsenSys include:

MetaMask: A popular browser extension wallet for managing cryptocurrencies and interacting with decentralized applications.

Infura: A cloud-based service that provides Ethereum infrastructure, making it easier to build decentralized apps.

Truffle Suite: A set of tools for developing, testing, and deploying smart contracts on Ethereum, with the Truffle Framework as the core development toolkit.

Quorum: An Ethereum-based blockchain platform designed specifically for enterprise use, focused on private and permissioned blockchain networks.

Codefi: A platform for asset management, tokenization, Initial Coin Offerings (ICO) organization, and other blockchain-based operations.

ConsenSys Academy: An educational platform offering courses and training programs on blockchain technologies and Ethereum.

They raised $725 million — crazy, right?

They raised $725 million — crazy, right?

We might not be able to afford their stock, but grabbing some of their crypto is definitely doable.

Some thoughts in my own words.

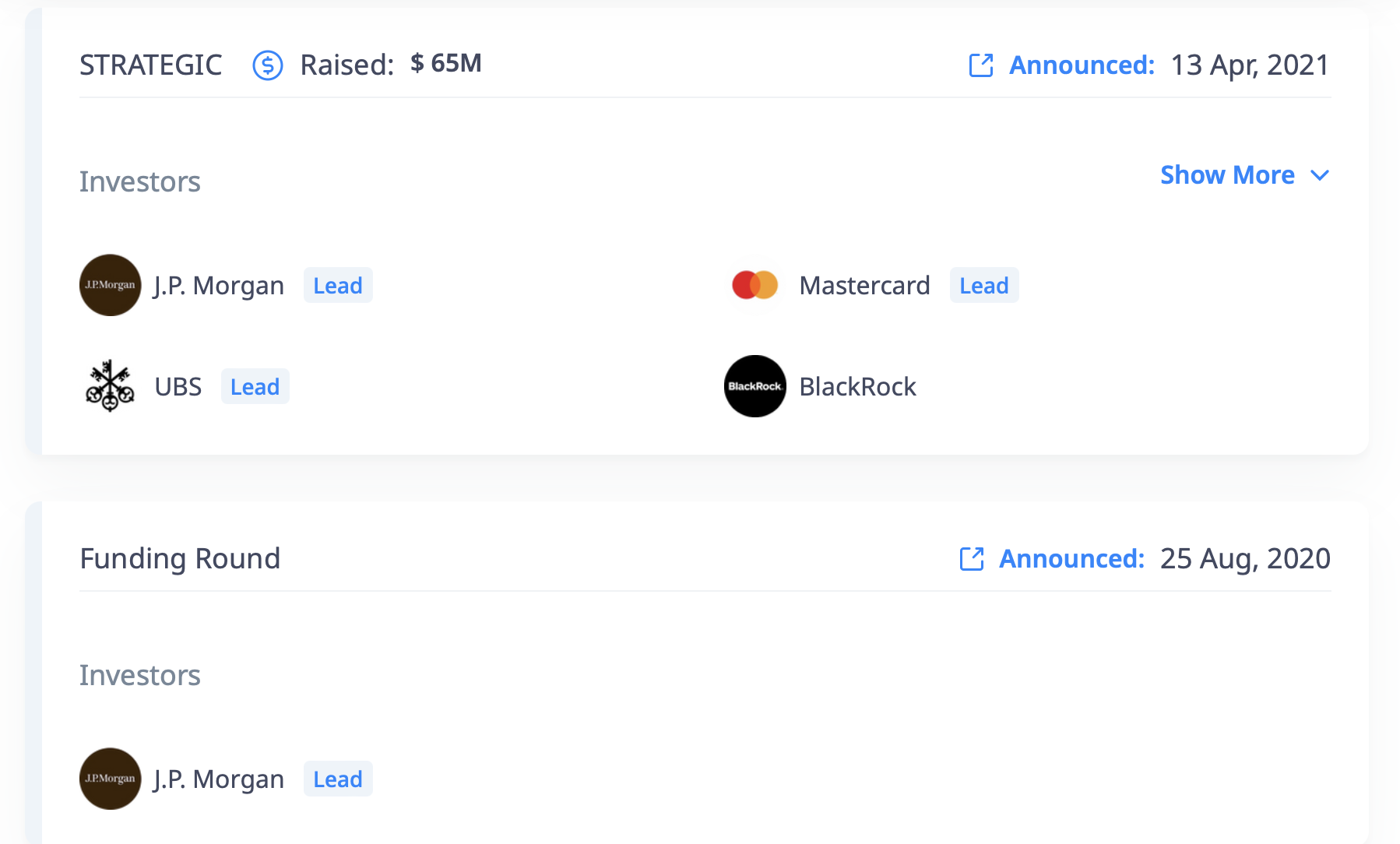

Remember what BlackRock did when they technically weren’t allowed to invest directly into Bitcoin?

They started buying up shares of MicroStrategy — one of the biggest (and very transparent) Bitcoin holders.

This situation is kinda similar. They’re jumping in as investors in a company that’s gonna be pumping out new projects.

Soon enough, ConsenSys shareholders are gonna be printing money.

And let’s be real — ConsenSys knows the Ethereum structure inside and out. They know exactly what the ecosystem needs.

You’ve seen those old-school billionaires trash-talking crypto like “Bitcoin is garbage” and all that?

Meanwhile, behind the scenes, they’re sneaking their way into crypto.

Of course, the real juicy stuff we’ll never fully see, but sometimes you catch glimpses if you’re paying attention.

I’ve decided I’m gonna keep an eye on the projects coming out of ConsenSys.

You can watch too — go check their “For the Ecosystem” section under Products here: https://consensys.io

They’ve got no issues with money.

They can easily throw down the cash they need whenever they want.

These guys aren’t just sitting around — they’re gonna pump “blue chips” as much as they can.

You can already see some names in their lineup — Linea, Teku, Besu (still need to dig into these myself).

If you’re broke or just starting out with very little money, seriously — get into airdrops.

Big players like ConsenSys always need active communities.

Someone’s gotta build the hype, and they often reward people for it.

They’ve already done a few official airdrops.

Just google it — seriously, it’s no joke.

You click around, complete some light tasks, and you might easily snag $1000–$3000.

Not bad at all, right?

Don’t be lazy — dig into it.

Also check out the Galxe project (different from ConsenSys) — there’s some free stuff going on there too (not an ad, just a heads-up).

If you wanna dive deeper, here’s what ConsenSys’ CEO Joseph Lubin recently said:

Joseph Lubin, CEO of ConsenSys and co-founder of Ethereum (ETH), told CNBC:

“A huge amount of sidelined capital is waiting to flood into crypto funds (ETFs).”

He explained that hundreds of billions of dollars are sitting in the hands of traditional finance pros, like pension funds and investment companies, just waiting for easier, more regulated ways to access digital assets through ETFs.

“In our industry, speculators have already pushed Bitcoin prices a bit higher in anticipation of the ETFs — and soon, hopefully, Ethereum ETFs too.

The bottom line: there’s a giant pile of money — hundreds of billions — sitting on the sidelines, just waiting to jump into digital assets.”

Lubin also said that although the SEC hasn’t made anything official yet, after Bitcoin, Ethereum is clearly the next strong candidate for a spot ETF.

“Ethereum might be the most mature ecosystem, the deepest ecosystem.

As a platform for decentralized apps, it’s global, it’s everywhere.

Bitcoin is a narrower technology — strong, but narrower — so they’re both the main players.

Solana’s a great tech, but it’s not as mature yet.”

Honestly, I have no doubt Ethereum is about to grab a ton of attention — and hit $7500–$10000 sooner or later.

-

Ethereum’s Hidden Power Move: Why ConsenSys Matters More Than You Think

-

The Real Crypto Game: BlackRock and JPMorgan’s Bet on ConsenSys

-

Not Just Bitcoin: Here’s Where the Smart Money Is Going

-

ConsenSys Is Quietly Building Crypto’s Future — And Big Banks Are Funding It

-

Crypto’s Future Isn’t Random — It’s Being Built by the Same Old Power Players

-

From Hating Bitcoin to Buying Crypto: How Wall Street Changed the Game

-

ConsenSys, BlackRock, JPMorgan: Quietly Setting Up the Next Crypto Cycle

Comments are closed.