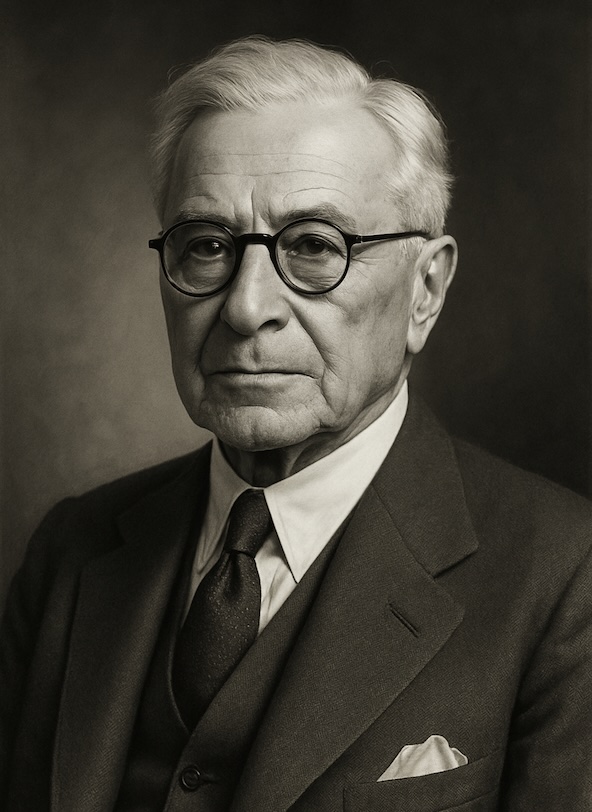

Bernard Baruch — The Investor Who Saw the 1929 Crash Coming

Full Name: Bernard Mannes Baruch

Born–Died: 1870–1965 (aged 94)

Peak Net Worth: Around $15–20 million in the 1930s (~$300M today)

Education: City College of New York

Background: Son of a doctor, raised in South Carolina

Career Highlights:

-

Started as a broker at A.A. Housman & Co

-

Became a self-made millionaire by 1903

-

Specialized in trading and early investments in industry

-

Sold most of his stock positions in 1928, avoiding the 1929 market crash

Government Roles:

-

Advised 3 U.S. Presidents:

-

Woodrow Wilson – Head of the War Industries Board during WWI

-

Franklin D. Roosevelt – Industrial mobilization advisor during WWII

-

Harry Truman – U.S. representative at the UN on nuclear policy (Baruch Plan, 1946)

-

Investment Style:

-

Preferred simple logic and cash over risk

-

Didn’t follow academic economic theories like Keynesianism

-

Believed in intuition, patience, and staying away from hype

-

Criticized by Ray Dalio later for not understanding debt cycles deeply enough

Death:

-

Died in New York on June 20, 1965

-

Left behind large holdings in bonds, land, and cash

-

Never went bankrupt and avoided major losses during major crashes

🔹 Most Used Quotes by Bernard Baruch in Trading Circles:

-

“I made my money by selling too soon.”

-

“Don’t try to buy at the bottom and sell at the top. It can’t be done — except by liars.”

-

“The main purpose of the stock market is to make fools of as many men as possible.”

-

“Cash is good to have — so you’re not forced to sell good assets in bad times.”

-

“Human nature doesn’t change. That’s why markets don’t change either.”

-

“The big money is not in the buying or the selling, but in the waiting.”

-

“The public is always too late — they come in at the top and leave at the bottom.”

-

“If you can’t afford to lose — don’t play the game.”

Comments are closed.